Li Auto’s Moment of Reckoning: a Burned EV, Losses, and Strategic Uncertainty - FOTO - VIDEO

A burning flagship model is rarely just a technical problem. For Li Auto — once celebrated for the success of the Li L9 and its disciplined growth — the MEGA fire has become a symbol of deeper strain, exposing financial pressure, strategic hesitation, and a market no longer willing to wait.

Li Auto built its reputation on the promise that it was different — more cautious, more disciplined, more reliable than its electric-vehicle peers. The Li L9, its breakout model, made that promise believable, turning the company into one of the rare profitable players in China’s fiercely competitive new-energy vehicle market. That reputation is now under pressure.

Pictured: Li L9 car

After a fire involving its heavily promoted MEGA electric model, amid falling deliveries and fresh financial losses, the question is no longer how Li Auto once succeeded, but whether it can still justify the confidence it asks from the market.

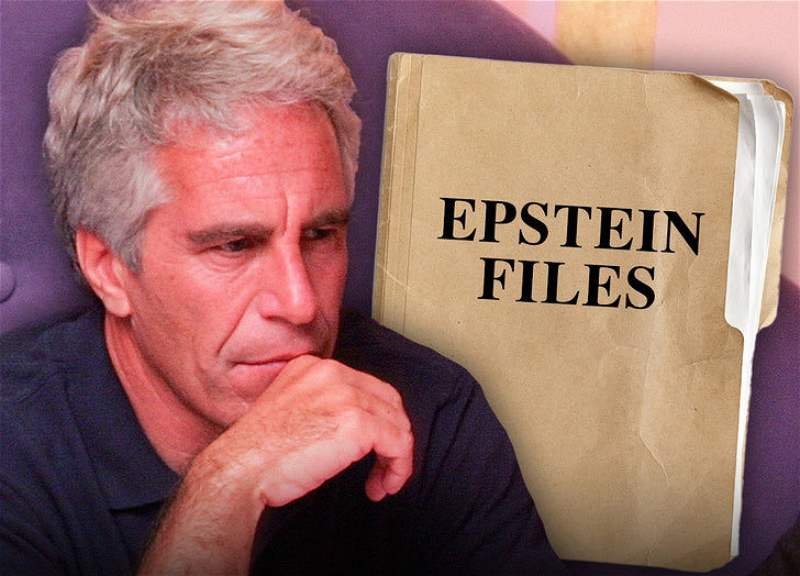

Footage shows: A Li MEGA car burned in Shanghai, China (October 23, 2025)

A Reputation Built on Restraint

Li Auto did not rise on bold bets or radical experimentation. It rose on restraint. The company found its niche by focusing on extended-range electric vehicles at a time when competitors rushed headlong into full electrification. The Li L9 embodied this strategy: a pragmatic, family-oriented SUV offering space, technology, and reliability without dependence on underdeveloped charging infrastructure. For several years, the formula worked. The Li L9 made the brand credible, commercially disciplined, and — in an industry notorious for hype — respectable.

That context matters, because it explains why recent events have resonated far beyond a single technical failure.

When a Technical Incident Becomes a Strategic Signal

Footage of a Li MEGA vehicle engulfed in flames circulated rapidly online, drawing intense scrutiny at a moment when Li Auto could least afford it. No casualties were reported, and the company moved quickly to manage the situation. Still, the incident struck a nerve. Within weeks, Li Auto announced a recall of more than 11,000 MEGA units due to a coolant-related defect linked to potential fire risks — a costly admission for a model positioned as a technological milestone in the company’s transition to pure electric vehicles.

The fire itself did not define the crisis. Its timing did.

Pictured: A Li MEGA car that burned in Shanghai, China (October 23, 2025)

From Profitability to Loss

The financial consequences were swift. In the third quarter, Li Auto reported a net loss of 624 million yuan (approximately USD 88.5 million) — its first quarterly loss after nearly three years of uninterrupted profitability. Revenue declined sharply year-on-year, deliveries fell by close to 40%, and gross margins compressed. Management pointed to recall-related costs as a key factor, but the numbers suggest a broader erosion of demand and momentum.

This was not a temporary stumble in an otherwise stable trajectory. It was a visible break in a narrative of steady, disciplined growth.

An Uncomfortable Transition to Pure Electric

For years, Li Auto’s extended-range strategy insulated it from many of the challenges facing fully electric competitors. But the market has shifted. In China’s core urban centers — Li Auto’s largest and most important market — pure electric vehicles now dominate policy support, consumer aspiration, and media attention. Li Auto’s transition into this space has been uneven.

Pictured: Li Mega car

The MEGA, intended as a statement of technological maturity, struggled to gain traction from the outset. Its design became the subject of widespread online criticism and mockery, its pricing left little margin for error, and early sales underperformed expectations. Subsequent models failed to compensate. Meanwhile, competitors such as XPeng and NIO reported delivery growth during the same period, underscoring Li Auto’s loss of competitive tempo.

A Brand Losing the Benefit of the Doubt

Strategic inconsistency has compounded these pressures. Over the past year, Li Auto has oscillated between governance models, experimenting with professional management structures before returning to founder-centric control.

Senior leadership reshuffles and public admissions of misjudgment by founder Li Xiang, reflected in company statements and investor communications, have reinforced the perception of a company searching for direction at a critical juncture.

None of this suggests imminent collapse. Li Auto remains well-capitalized, retains strong brand recognition, and continues to benefit from a loyal customer base built during its extended-range heyday. But the market no longer grants the benefit of the doubt. In an industry where confidence functions as currency, hesitation is costly.

The contrast with Li Auto’s own past narrative is striking. This was the company that promised disciplined execution in a chaotic sector — the adult in the room while others chased headlines. Today, it is explaining a flagship recall, absorbing losses, and watching rivals move ahead.

Pictured: A Li ONE vehicle that burned down in China's Sichuan province (August 2023)

For regional markets and partners far from China’s domestic battlegrounds, the implications are difficult to ignore. Strategic uncertainty at headquarters inevitably shapes brand credibility abroad. A company under pressure at home has limited room to project certainty elsewhere.

Li Auto’s challenge is no longer purely technical or cyclical. It is existential in a quieter, more dangerous sense: can a brand built on caution adapt quickly enough in a market that now rewards speed, clarity, and conviction?

The answer remains open. What is clear is that the MEGA episode has stripped away the comfort narrative that once surrounded Li Auto. The company is no longer judged by what it achieved with the Li L9, but by how it responds when its core assumptions are tested.

For a brand that became famous by avoiding risk, this may be the hardest test of all.

Andretti

Exclusively for 1news.az

Read in other languages:

Li Auto üçün həqiqət anı: yanan elektromobil, zərərlər və strateji qeyri-müəyyənlik - FOTO - VİDEO