How Bank Avrasiya Dethroned the Bank of Ramiz Mehtiyev’s Family from Its Position as the Market’s Worst Performer

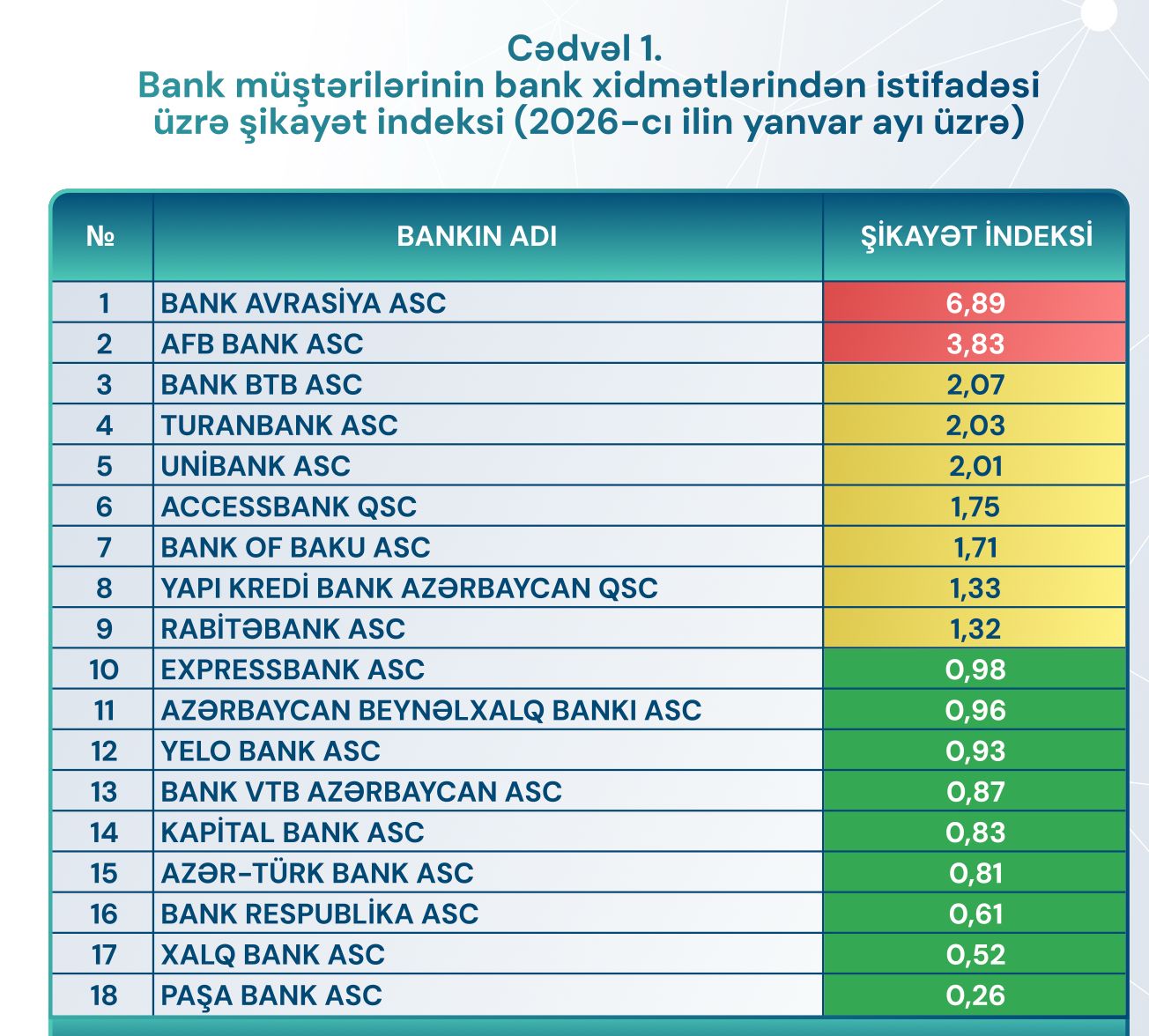

The Central Bank of Azerbaijan (CBA) has published its complaint index for January 2026, and the results can be considered nothing short of sensational.

Bank Avrasiya, which appeared in the 2025 reports only once (April, index 3.07), surged to the top of the negative ranking in January 2026 with an index of 6,89 — one of the highest figures in the entire history of these reports.

This result is reason enough not only to examine the January report, but also to look back at the entirety of 2025 in order to assess which banks exhibit systemic service failures and which have learned to handle customers so well that complaints never reach the regulator.

I. The Main Story — Bank Avrasiya

A Staggering Lead

Bank Avrasiya’s January index of 6,89 — means that the bank’s share of complaints is nearly seven times its share of the sector’s customer base. For comparison: the runner-up in the negative ranking, AFB Bank, posted an index of 3.83, and the third-placed Bank BTB — 2.07. Bank Avrasiya’s lead over its nearest “competitor” is nearly twofold.

Retrospective: From Ghost to Worst Performer

In 2025, Bank Avrasiya appeared in the CBA report only once — in April, with an index of 3.07 (2nd place). For the remaining 11 months the bank was absent from the ranking, meaning zero complaints filed with the regulator. At the time, that single appearance could have been written off as a small customer base artifact — a statistical fluke. January 2026 dispelled that hypothesis.

Context: “The Anatomy of Bank Avrasiya”

Not long ago, our website published a detailed analysis of the bank. Key findings: an instant liquidity deficit of AZN 30 million, guarantees amounting to 94% of capital, dependence on government funding (41% of liabilities), 92% NPL — overdue for more than a year. The bank exhibits signs of a captive bank serving a limited circle of beneficiaries.

The link between the bank’s financial condition and customer dissatisfaction is transparent: the liquidity deficit likely generates operational failures — delays, errors, refusals — which, in turn, generate complaints to the CBA. The financial pathology described in our analysis has now materialized as customer dissatisfaction. An index of 6.89 is not a statistical outlier but a symptom of systemic problems.

Read more:

II. “The High-Pressure Zone” — Chronic Underperformers

January 2026 has shown that some of the troubled banks of 2025 remain in the red zone, even if the amplitude varies.

Bank BTB: The Undisputed Worst Performer of 2025

January 2026 — index 2.07, 3rd place. This is noticeably better than December’s 6.00 or February’s 7.65, but the bank remains firmly in the red zone. In 2025, Bank BTB was the undisputed worst performer: an average index of 4.04, holding the top spot in the negative ranking for 6 consecutive months (July–December), with an escalating trajectory — from 3.71 in July to 6.00 in December. The bank appeared in CBA reports in 10 out of 12 months, and in all 10 months it was in the red zone.

The decline in the index in January 2026 may reflect not so much an improvement in service as a further contraction of the customer base: fewer customers — fewer complaints in absolute terms.

We have analyzed in detail the problems of this bank, which is linked to the family of the former Head of the Presidential Administration of Azerbaijan, Ramiz Mehtiyev, and unfortunately, those problems extend well beyond a shrinking customer base.

Read more:

The stagnation of Bank BTB: Concrete assets, liquid fears

Yelo Bank: An Unexpected “Remission”

January 2026 — index 0.93, 12th place, green zone. This is a surprise: in 2025, Yelo Bank spent 11 out of 12 months in the red zone (average index 2.69), twice topped the negative ranking (June — 3.75), and was consistently among the three most problematic banks. Whether this is a one-off improvement or the beginning of a trend — the coming months will tell.

Unibank: Persistently Limping Service

January 2026 — index 2.01, 5th place, red zone. In 2025 — 10 out of 12 months in the red zone, average index 1.95. Unibank shows neither sharp deterioration nor signs of improvement — a chronic dysfunction of service that reproduces the same picture month after month. In all likelihood, the bank is paying the price for its aggressive marketing-driven growth strategy.

Yapı Kredi: Volatile, but with a Positive Trend?

January 2026 — index 1.33, 8th place, yellow zone. In 2025, Yapı Kredi posted an average index of 2.69, spent 10 out of 11 months in the red zone, and topped the negative ranking three times (January, March, April). The range of fluctuations over the year — from 0.72 to 3.89 — indicates extreme volatility. The January reading of 1.33 may be a temporary improvement.

III. “Retail Overload” — The Tax on Mass Scale

Bank of Baku: The Vulnerability of Scale

January 2026 — index 1.71, 7th place. In 2025, the average index was 1.43, with the bank falling into the red zone in 4 out of 12 months. With 19.9 million cards issued, even 0.001% of operational failures generates thousands of dissatisfied customers. Thus, Bank of Baku is a bank whose scale makes it vulnerable to the so-called “popularity tax.” Every technical glitch, every app update, every queue at a branch is multiplied by millions of users.

In our recent analysis of the bank, we noted that Bank of Baku’s rapid growth strategy creates strain on several fronts: rising overdue debt, negative fee economics on cards, capital compression, and declining profits despite portfolio growth. As we can see, customer satisfaction levels can be added to the list of challenges.

Read more:

Bank of Baku: The Hidden Price of Growth

AFB Bank: An Alarming Spike

January 2026 — index 3,83, 2nd place, red zone. This is a sharp spike: in 2025, the average index was 1.49, and the bank appeared in 8 out of 12 reports. What happened in January? This question warrants a separate investigation (we will publish an analysis of this bank in the near future).

IV. “Radio Silence” — Why the Leaders Stay Quiet

Six banks never entered the red zone across all 12 months of 2025. Five of them are industry giants: PAŞA Bank (avg. 0.33), Xalq Bank (0.56), Bank VTB (0.63), ABB (0.82), Kapital Bank (0.91). They are joined by Ziraat Bank (0.74).

In January 2026, all of them are once again in the green zone.

How can this consistent “silence” be explained? Three non-mutually exclusive, hypotheses:

Bank-level prevention. Large banks invest in CRM systems, internal complaint resolution units, chatbots, and front-office solutions. Complaints are resolved at the bank level and never reach the regulator. A low index does not mean an absence of problems, but rather a functioning system for resolving them.

Micro-level issues. At a well-functioning bank, operational failures are so minor that the customer sees no reason to contact the CBA. The “pain threshold” is simply never reached.

Segment specificity. PAŞA Bank, for instance, primarily serves the corporate and premium segment, where issues are resolved by a personal manager. For ABB and Kapital Bank, with their mass-market reach, a low index is an indicator of genuinely effective processes, not “loyalty by inertia.”

Conclusion: a low complaint index is a sign of business process maturity. We contrast the systematic approach of the leaders with the operational fever of the laggards. The gap between the best and worst banks by index reaches a 70-fold difference (PAŞA Bank 0.09 vs Bank BTB 6.00 in December 2025).

V. Summary Table: 13 Months (Jan 2025 — Jan 2026)

The CBA does not publish consolidated data — each month a separate report is issued. Below is a consolidated table compiled by the First News Intelligence Unit based on all 13 reports.

Color coding: red — index ≥ 2.0 (critical zone); yellow — from 1.0 to 2.0 (watch zone); green — below 1.0 (normal). A dash indicates the bank’s absence from the report (zero complaints).

.png)

* Average for the single month of appearance in the report.

Worst Performer of the Month: A Chronicle

January–April 2025: rotation of negative ranking leaders — Yapı Kredi (January, March, April), Bank BTB (February). May: Turanbank. June: Yelo Bank. July–December 2025: Bank BTB monopolizes the bottom position for 6 consecutive months with an escalating trajectory (from 3.71 to 6.00).

January 2026: Bank Avrasiya knocks BTB off the top spot — 6.89.

VI. Synthesis: From Statistics to Strategy

Thirteen months of data allow us to draw several systemic conclusions.

The complaint index correlates with a bank’s financial health. Bank BTB and Bank Avrasiya are banks with serious balance sheet problems, described in detail in First News Intelligence Unit publications. Their customers feel it: operational failures caused by financial weakness inevitably translate into a stream of complaints to the regulator.

Some banks have turned the CBA into their “complaint book,” while others resolve problems within their own systems. The gap between leaders and laggards by index reaches a 70-fold difference. This is not a coincidence — it is a difference in management approaches, investment in customer service, and the culture of handling complaints.

First News Intelligence Unit investigations provide the analytical foundation. Our analyses of Bank BTB, Bank of Baku, and Bank Avrasiya explained why some banks have the resources for quality service and others do not. The January CBA report confirmed our conclusions: financial pathology sooner or later manifests itself in the customer experience.

A question for the CBA: is the complaint index used as a factor in supervisory response? Banks with a persistently elevated index above 2.0 — and in 2025 there were at least four of them (Bank BTB, Yelo Bank, Yapı Kredi, Unibank) — show signs of managerial erosion.

If the complaint index remains merely an informational product and does not become a trigger for supervisory action, its potential is not being fully utilized.

Methodological Note

The CBA complaint index is calculated using the following formula: Index = Bank’s share of total complaints / Bank’s share of total active customers in the sector. An active customer is defined as an individual with an account balance of at least 100 manats and at least one transaction in the past three months. Repeat complaints, inquiries related to credit benefits, and matters outside the CBA’s competence are excluded from the calculation. An index above 1.0 means that the bank generates a disproportionately high number of complaints relative to its customer base.

CBA categories: the “red” zone — index above the sector average; “yellow” — average level; “green” — below average. In this article, we additionally use the 2.0 threshold as a marker for the critical zone.

All data is sourced from open reports of the Central Bank of Azerbaijan.

🌐 Read in other languages: