The stagnation of Bank BTB: Concrete assets, liquid fears

In the rapidly modernizing landscape of Azerbaijani banking, where market leaders are racing toward digital ecosystems, Bank "BTB" ASC remains a structural anomaly.

It is a relic of a bygone era, an institution whose balance sheet tells a story not of commercial competition, but probably of "captive" financing and political patronage.

A forensic analysis of the bank's audited financial statements (2015–2024) and quarterly prudential filings (up to Q4 2025) reveals a lender that has effectively ceased to function as a commercial bank.

Instead, it operates as a distressed asset warehouse, managing a legacy of problematic loans and funding a specific real estate portfolio, all while hovering dangerously close to the regulatory minimum capital requirement.

The bank’s trajectory also offers a rare, quantifiable glimpse into the decoupling of business and politics. The data suggests that Bank BTB’s business model was not built on market principles but on the "administrative premium" provided by its once-powerful owners.

When that political cover evaporated in 2019, the bank’s financial engine seized up.

The Mehdiyev Variable

The ownership of Bank BTB is a matter of public record, disclosed on the bank's website as required by the Central Bank of Azerbaijan. Three shareholders control the institution: Nigar Mehdiyeva holds 76.7%, Rza Sadig holds 17.7%, and Tukazban Mahmudova holds 5.6%.

According to open sources, Nigar Mehdiyeva and Rza Sadig are siblings. Together, they control 94% of the bank. R.Sadig also serves as Chairman of the Supervisory Board.

Nigar Mehdiyeva is the daughter-in-law of Ramiz Mehdiyev, who served as Head of the Presidential Administration from 1995 until October 2019—a tenure of nearly a quarter-century during which he was widely regarded as the second most powerful figure in Azerbaijan.

The correlation between the bank’s financial health and Mehdiyev’s political career is near-perfect, suggesting a causal relationship that goes beyond coincidence.

· The Era of Expansion (up to 2019): While Mehdiyev held office, the bank enjoyed a period of aggressive asset accumulation. Total assets grew from negligible amounts to peak levels of over 380 million AZN. The bank was consistently profitable, expanding its branch network into prime locations.

· The Pivot Point (October 2019): Mehdiyev’s dismissal marked the exact turning point in the bank’s data.

o 2020: Immediately following the political shift, the bank swung from stability to a massive 9.1 million AZN net loss.

o 2021–2023: While the rest of the banking sector recovered from the pandemic, BTB continued to bleed. It posted a 4.97 million AZN loss in 2022 and a 2.78 million AZN loss in 2023.

· The "Pariah" Phase (2024–Present): According to preliminary prudential filings for 2025, the bank has entered a state of forced contraction. It has closed its flagship branches, reduced staff from ~390 to 266, and shrank its total assets to 356.8 million AZN. While losses narrowed to ~400k AZN in 2025, this "stabilization" appears driven by aggressive cost-cutting rather than business growth.

A real estate hedge fund in disguise

The most striking structural feature of Bank BTB's balance sheet is its extreme concentration in real estate. A healthy commercial bank diversifies across sectors—trade, manufacturing, agriculture, services.

Bank BTB has not.

According to Q4 2025 prudential filings, the bank's loan portfolio breaks down as follows:

· Real estate and mortgage loans comprise AZN 172 million, or 69.4% of total lending.

· Business loans account for just AZN 33.7 million (13.6%).

· Consumer loans make up AZN 34 million (13.7%).

Nearly seven of every ten manat lent by the bank is tied to property.

This concentration raises an obvious question: is the bank financing projects connected to its shareholders?

The Mehdiyev family is known to have interests in construction. The answer, according to regulatory filings, is technically no—the "Related Party Lending" ratio sits at approximately 2%, well below the Central Bank's ceiling.

But the structure suggests something more subtle. Rather than lending directly to developers (which would trigger related-party limits), the bank probably lends to the buyers of properties. The mechanism is sometimes called "vendor financing": a developer builds apartments; a connected bank provides mortgages to purchasers; cash flows back to the developer at the point of sale, while the bank assumes multiple years of credit risk.

The developer gets liquidity. The bank gets a balance sheet full of long-dated, illiquid assets.

This interpretation is supported by a second anomaly in the data. According to the "Collateral Distribution" filings, nearly 100% of the bank's business loans are secured by real estate. This is not normal commercial banking, where loans are extended against cash flows, receivables, or inventory. This is asset-based lending—pawnbroking for property. It further concentrates the bank's exposure to a single variable: Baku real estate prices. A 10–15% decline in property values would vaporise the collateral buffer.

The Zombie Traits

Beneath the headline figures, the granular quarterly data reveals a bank that is structurally unprofitable and facing a severe liquidity mismatch.

The liquidity trap: The bank's "Maturity Profile" filings expose a dangerous gap.

On the asset side, BTB holds approximately AZN 216 million in loans maturing in five years or more—overwhelmingly mortgages. On the liability side, it funds these assets with customer deposits that mature in less than twelve months. In Q4 2022, the cumulative liquidity gap for maturities under one year was negative AZN 123 million. The bank is, in the jargon, engaged in extreme "maturity transformation." It is perpetually dependent on rolling over short-term deposits to fund long-term loans. In theory, it is illiquid. In practice, it survives because depositors have not yet lost confidence—and because regulators have not forced the issue.

The hopeless bucket: Asset quality is worse than the "stabilised" 2024 loss suggests. According to Q4 2025 filings, the bank carries AZN 18.55 million in non-performing loans. Of these, AZN 10.69 million—57.6%—are classified as "Hopeless." These are not struggling loans awaiting restructuring. They are dead: generating no interest income, requiring full provisioning, sitting on the balance sheet like zombies. Many likely represent legacy lending to businesses that ceased servicing their debts once the political winds shifted.

The cost-of-funds squeeze: Why can the bank not earn its way out of trouble? The income statement provides the answer. Bank BTB pays out approximately 58–60% of its gross interest income merely to cover interest expenses on deposits. To attract funds to a small, politically exposed institution with a troubled reputation, it must offer depositors a risk premium. This crushes net interest margins, leaving almost nothing to cover operating costs and loan losses. The bank is trapped: it cannot grow profitably, and it cannot shrink fast enough to escape its cost base.

Walking the Fifty-Million Line

The most immediate threat to Bank BTB is regulatory.

The Central Bank of Azerbaijan maintains a hard floor for aggregate capital: AZN 50 million. Fall below it, and the license is at risk.

As of Q4 2025, Bank BTB reported total regulatory capital of AZN 53.27 million—a buffer of just AZN 3.27 million, or roughly 6%, above the minimum. This is a razor-thin margin. A single large corporate default, or a regulatory audit that forces a revaluation of the bank's investment property holdings, could eliminate the buffer overnight.

This explains the capital measures visible in recent filings. In 2024, the shareholders converted AZN 5 million in subordinated debt to ordinary share capital. This was not an investment for growth; it was a rescue injection to prevent the license from being pulled. Earlier, in 2017, a share issuance of AZN 14.5 million served a similar purpose. The pattern is clear: the bank survives on periodic transfusions from its owners. They are, in effect, paying a subscription fee to keep the institution alive.

Bottom of the Table

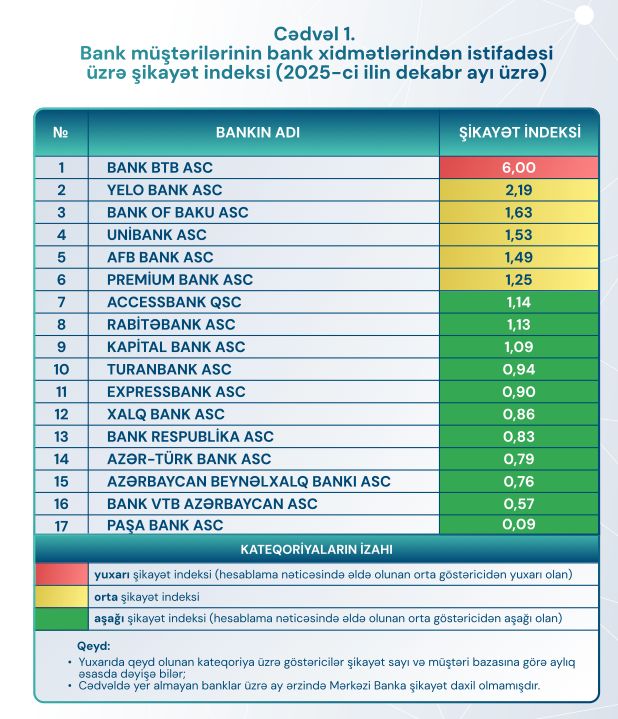

If the financial statements describe the bank's internal condition, the Central Bank's customer complaint index offers an external view. The index measures complaints received by the regulator relative to each bank's share of active customers.

From July 2025 to December 2025, Bank BTB ranked first, which is to say, worst, every single month except August. In December, its complaint index of 6.0 was almost 70 times higher than the best performer (PASHA Bank, at 0.09). The Central Bank colour-codes its rankings: green for low complaints, yellow for medium, red for high.

Bank BTB is deep in the red.

The End of the Line

Bank BTB has stabilised, in the sense that a patient in palliative care is stable. The losses have shrunk—from AZN 9.1 million in 2020 to AZN 0.2 million in 2024—but only because the bank has cut to the bone. Branches closed, staff dismissed, lending curtailed. It has stopped the bleeding by stopping almost everything else.

“The Strategic plan 2025-2027”, approved by shareholders, is probably a preparation for exit rather than expansion. The bank has no viable path to organic growth. New Central Bank regulations cap high-yield consumer lending; BTB is already near the limit. It cannot compete with larger institutions on business lending rates. The mortgage market is saturated, and the bank lacks cheap funding to compete.

It is, in the language of energy economics, a stranded asset.

Two scenarios present themselves.

In the first, a larger banking group acquires BTB for its license and headquarters, liquidating or writing off the legacy loan portfolio.

In the second, the bank continues its slow contraction as long-term mortgages are gradually repaid, eventually surrendering its license when the loan book becomes too small to cover fixed costs.

Either way, the institution that once expanded across Baku's prime districts is unlikely to survive the decade in its current form.

Bank BTB's customer base is shrinking along with its balance sheet, its capital buffer, and its options. What remains is a monument to its corporate history—an era when the political weight of its founders, not financial acumen, was the primary currency.

That currency has now been devalued. The branches are dark, and the numbers tell the story.

Author:

First News Intelligence Unit

____________

This analysis is based on IFRS-audited financial statements (2015–2024), Central Bank of Azerbaijan prudential filings and complaint index data, and official corporate disclosures.

Read in other languages:

Стагнация Bank BTB: «бетонные» активы и проблемы ликвидности

Bank BTB-nin staqnasiyası: “beton” aktivlər və likvidlik problemləri